15 Month Performance Review: Betterment vs. Wealthfront vs. S&P500 vs. Other Options

I wrote this post in August 2014 comparing Betterment to Wealthfront, so it's been about 15 months, and I thought it'd be a good time to check in on relative performance, as a buddy of mine recently wrote:

"I saw your post on betterment. I'm thinking of moving everything over to a roboinvestor. What's your thinking on betterment vs wealthfront, and whether you'd just dump everything on there?"

As I wrote in my original post, I put $5k into both Betterment and Wealthfrontto test them against each other. To date, both have under-performed the S&P 500 by a considerable margin. S&P is up 10% since August 2014. Betterment is down by 2% and Wealthfront is down by 5.4%. So, should I just have invested in the S&P 500? And as per my other previous blog, Show Me The Money: Six Strategies to Put Your Cash to Work, how should I re-allocate based on this new data? And what would I recommend to my buddy? Let's dig into the data a bit to come to a conclusion:

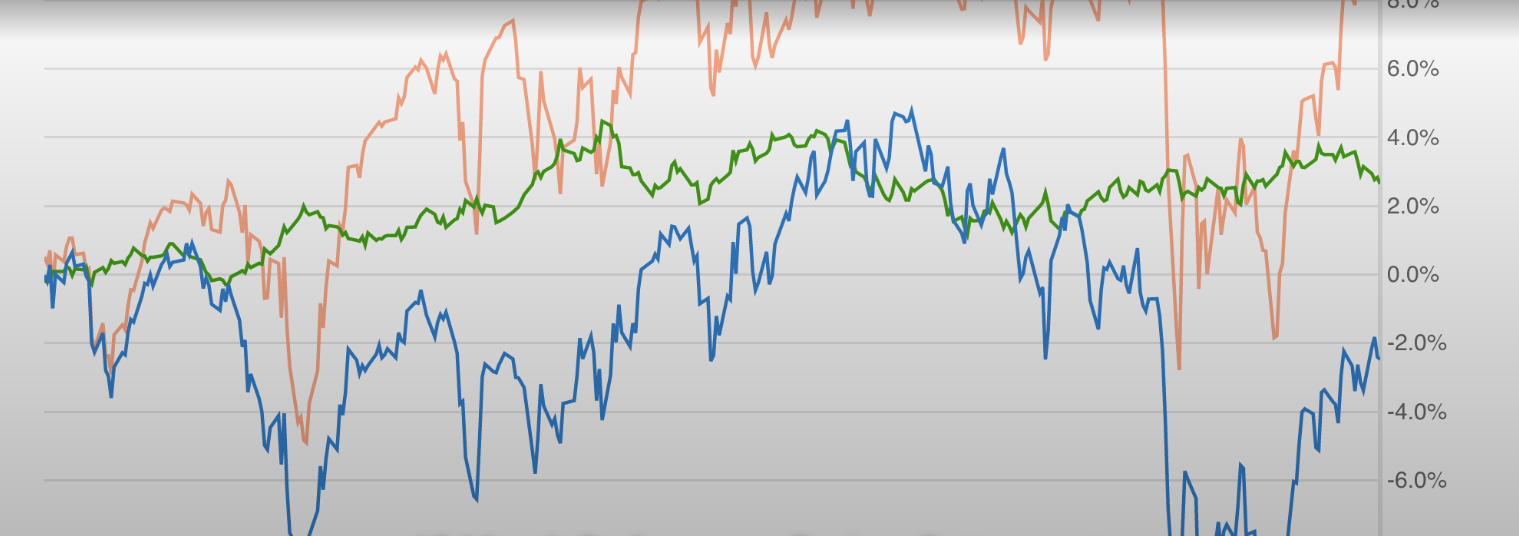

Here's a chart in my Betterment dashboard that compares the performance of my Betterment investment (in orange) to the S&P 500 over the same period (in blue). I also threw in a Vanguard bond fund's performance just for a benchmark on how a more conservative investment has done:

Sadly, Wealthfront's dashboard isn't nearly as sophisticated. Here's all they show me:

Interestingly, here's how the Wealthfront has actually performed vs. how they predicted it would:

Meanwhile, in my "six strategies" blog post I referenced investing in peer to peer micro-lending via LendingClub, and then I wrote this update on using the LendingRobot API to be more sophisticated about how I do the P2P lending. Here's the LendingRobot dashboard of my P2P returns to date:

So LendingRobot is predicting that the money I invested in LendingClub using its "automated investing" service (before I knew that LendingRobot existed) will return 8.92%, but the money I'm investing in LendingClub using the more sophisticated rules I've created with LendingRobot will return 13.20%, for a blended return of 9.79%. Needless to say, I've stopped using LendingClub's automated investing service and am using LendingRobot exclusively for all investments in LendingClub moving forward. But let's just assume I can make an average of a 10% return in LendingClub. Does that mean I should move all the ETF investments over to LendingClub?

Well, not necessarily: There are several drawbacks to P2P investing, namely:

- Income that comes from P2P lending is taxed at ordinary income rates, whereas equities that are held for a year or more are taxed at long-term capital gains rates.

- Dollars put into P2P are very illiquid because they're deployed into 36 to 60 notes, whereas the Betterment ETF funds are immediately available if needed.

- The interest rate of those 36 to 60 months notes are fixed, so if inflation were to kick into gear in a big way, those returns would be fixed while costs rise. Arguably equities could perform better in a higher inflationary environment, or at least the money is more liquid so I could move it to other places.

And to add to the complexity, I recently found a Vanguard high yield ETF that's returning a 3.11% yield, which provides for a blended approach: the liquidity and tax benefits of long-term-hold equities with some of the income elements of P2P lending.

So at the end of the day, here's my answer to my buddy who asked: Your decision really has to be based on your goals. Are you looking for an income producing asset? Are you willing to deploy cash in a risky way? In that case I'd focus on putting cash into LendingClub, via LendingRobot. But conversely, are you looking to stash cash somewhere that it can grow with the markets, where you don't need any immediate income from it? In that case I'd go with equities because historically they return in the 7% range annually, they're more liquid and get better tax treatment. And even though the Betterment and Wealthfront investments have greatly under-performed the S&P 500 over the past 15 months, I'm still sticking with them for now (and for the bulk of my cash, with Betterment specifically, which I greatly prefer over Wealthfront from a user experience perspective). Logically, I buy into their approach -- I like the Tax Loss Harvesting, I like the diversification into large, mid and small cap stocks and emerging markets. But I'm definitely going to keep tabs on how things go over the next couple of years, and I'll keep writing these updates (I'm in this for the long haul -- here's to decades of updates!). If I don't see Betterment start to out-perform other alternatives over a multi-year period, I'll likely change my approach.

I'd love to hear feedback from anyone who loves to geek out on this as much as I do! And for those of you who don't invest at all: Start with something small. $50. $100. Just get into it. Try a few things. There's a world of difference between $0 and $100, even just in the way you feel like you're investing in yourself and your family's future.